EPF online payment in India the following guide will let you know the complete procedure about the process of online pf payment in India via Employees Provident Fund Organisation.

The following article will be divided into six categories which will be helpful for beginners who are new into the field of the corporate sector.

Starting with the core sectors, if a company should have more than 20+ people should proceed the epf payment online demo( employers provident fund ) or via offline.

As per government rules and regulations, the last date of PF contribution is 10th to 15th of every month doing any delay can cause troublesome.

As an employer, you need to follow certain rules and regulations which will share by the government of India(EPFO) in 2011 under the epfo(employers provident fund) act.

The process of proceeding the epf payment online under corporate account has been discussed below. Please do check it out. If you encounter any problems while you have been proceeding the pf online payment, then do leave a comment below our dedicated team will help you related to this query about epf payment via EPFO ( Employees Provident Fund – e sewa ) portal.

EPFO LOGIN: Registration Process For New Account

Before you have to make an pf online payment, you need to register first via e – sewa website which was launched back in 2011.

This process should be done first, later followed by, generate ECR ( Electronic Challan Return ), submitting of ECR which will be discussed here through step by step wise.

Please make sure that you need to have a working mobile number to complete the registration process for epf payment online.

- Do let us know if you encounter any problems while e- filling out the new registration process for pf payment online in India.

REGISTRATION PROCESS:

- Here is the official link to create your account: Link here

- In case if you have an account then do check out here: Link here

And skip the following tutorial about the creating of a new account – If you already have an account you can proceed the upload of ECR followed by pf challan online payment.

Once, you have visited the above link ( New registration ), then all you need to do is check out the following tutorial about the creation of a new account with images.

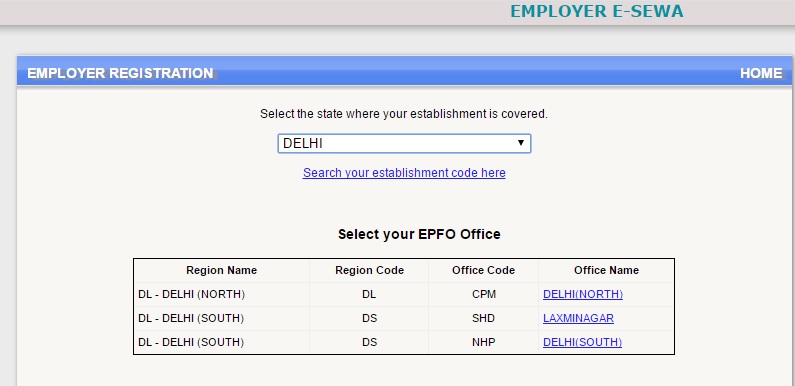

- First of all, you need to select the state where your employer tax and other department belongs – this is crucial part if you done any mistake you won’t make online PF payment.

- Then after choosing your office code and region code followed by office name as shown in the following image.

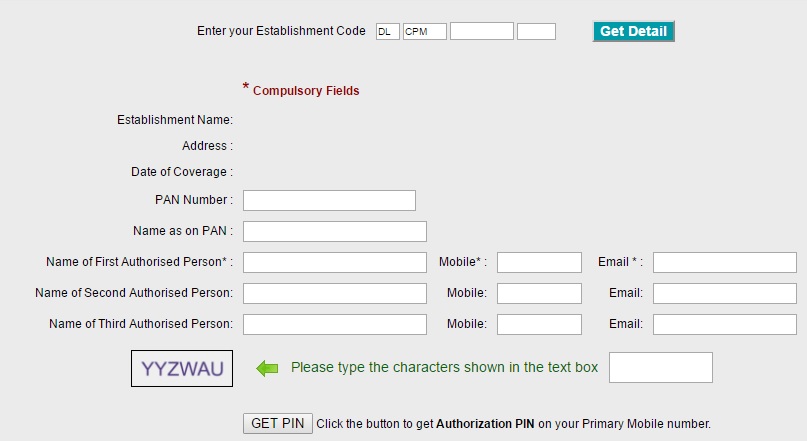

- Now, once, you choose the office name, the web page will automatically redirect to a new webpage where you can fill out the application form details to proceed the registration of new PF account.

- This is how the web page will look alike once, you have been redirected.

- Now, choose your establishment code, in case if you have forgotten or no idea about the establishment code, you can check out here. This will help you out to find your establishment code:

Note: Establishment Code – Maximum 7 Digits, No leading or trailing zeros (e.g. 3467, 987654, etc.Once,) and Extension – Maximum 3 Characters / Can be left blank in case no extension.

Proceed further by filling out the application form :

- Pan Number

- Name as on pan :

- Name of First Authorized Person

- Name of Second Authorized Person

- Name Of Third Authorized Person

- Followed by the mobile number and Email Id of all

Once, you did those filling out the new application form to make epf online payment Now, click on get authorization pin which will receive to the first Authorized person mobile number.

- Now, enter that pin at the end of the page and get access to enter into the portal website to complete the rest of the process of pf online payment.

That’s the first step you need to do. Now, the second phase is to fill generate Electronic Cum Challan Return.

Generate Electronic Challan (ECR)

The Electronic Challan Return : Two Phases ( Must )

- Process of Creating The ECR File ( Text Version )

- Uploading The ECR In a Portal Website

Process Of Creating The ECR File – Text Version

This is one of the biggest hurdles to those, however, with our tutorial, you can make it more easier than you thought.

We are pretty sure that as employer, maybe your team will have good command on Excel Sheet I think so.

- Okay whatever, here is the complete format which we are going to share with you which will be helpful on how to generate ECR, electronic challan return format in order pf payment online.

First of all download the pdf file, the .pdf file consists of complete format on how to fill out the CSV and convert into ( Hash Tilda hash ) – #~#

The Electronic Challan cum Return (ECR) will be an electronic return in plain text format and will consist of DETAILED lines (one line for each member).

How To Prepare ECR as a Text File:

Once, you downloaded the above pdf file, you will get to know on the complete mandatory fields to be filled for epf online payment.

However, there is another file that you need to be download. The file will contains .js scripts which will explain you the complete info.

- Here is the link to download ( Zip File )

- Once, you have done with a download ( Zip file) extract it with by using WinRAR software.

- Now, you will see HTML file with an extension ( ECRPRESENTATIONWORK.HTML) just open that one.

- Make sure to open that .html file in google chrome only.

- This is how it would look alike once you opened the file.

This zip file contains the other extensions, like .js, will help you to automatically explain on how to create an ECR text file format.

- Please go through the tutorial as shown in the above .html version

- Once, you have complete in filling out the data in a CSV format.

- Now , save as (*.csv ) – Comma delimited.

- Now, open that file with TextPad.

- Replace comma (,) with ( #~# ) and save that file.

- Remove the top header on a text file, and save as .txt format.

That’s it

Now, Your ECR file is ready to upload on portal website. Hope the above tutorial will help you out in case if you need any information about the creating of ECR ( Electronic chall cum return ) to make pf online challan payment text file do let us know in the comment section.

- NOTE: Please do refer the above steps in case if you won’t understand. Two files that are mandatory to download are PDF file and .zip Version. Once you downloaded the .zip version, unzip it and open the Ecrpresentation.html file in google chrome only and follow the instructions.

Upload ECR File Via Portal With Images – EPF Payment Online

Back in 2012, the EPFO government launches an online facility to make epf online payment.

where you can generate online signed ECR and proceed the payment online via any bank sector under a corporate account.

Once, the employers uploaded the electronic challan (ECR), the uploaded return data will be displayed through digitally signed copy which will further available in a PDF format ( Printout purpose ).

Once it was approved by the employer either you can make payment via online through net banking or submit those details near by any bank via offline and proceed the payment.

Here are the complete information about on how to proceed to upload the ECR challan online through epfo login portal.

We make sure to cover each and every point which will further helpful in case if you are done any mistake. Check out the tutorial here.

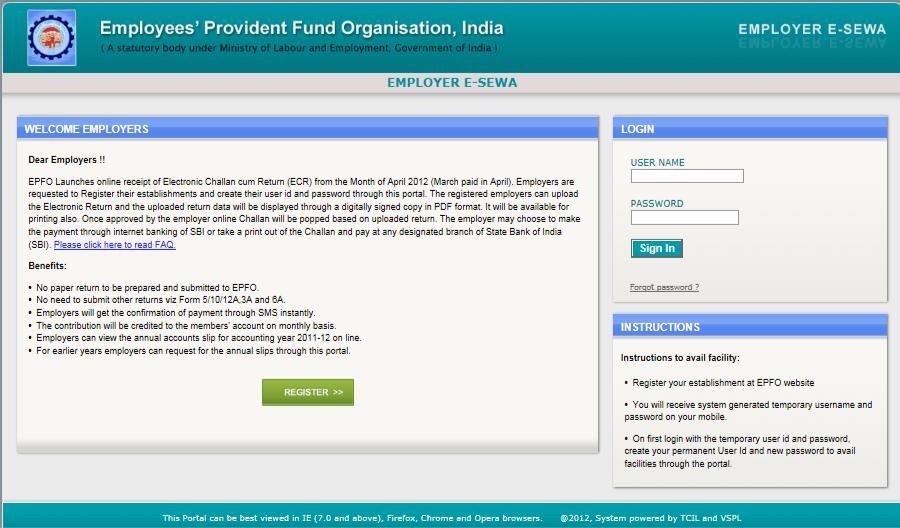

- As we mentioned above once you have done your registration, then all you need to login via that webpage.

Once, you logged into the web page it looks alike as follows:

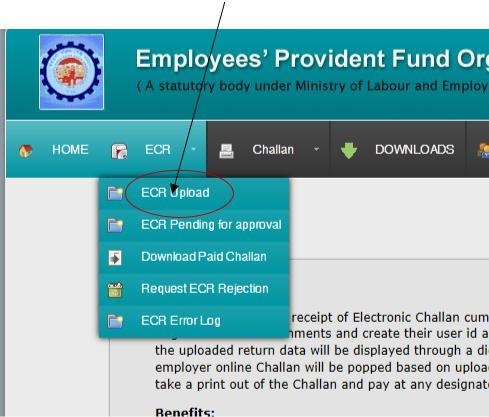

- Now, at the top of the menu bar, you will see an option to upload ECR ( Electronic challan cum Return ). Just check out to that webpage as shown as below.

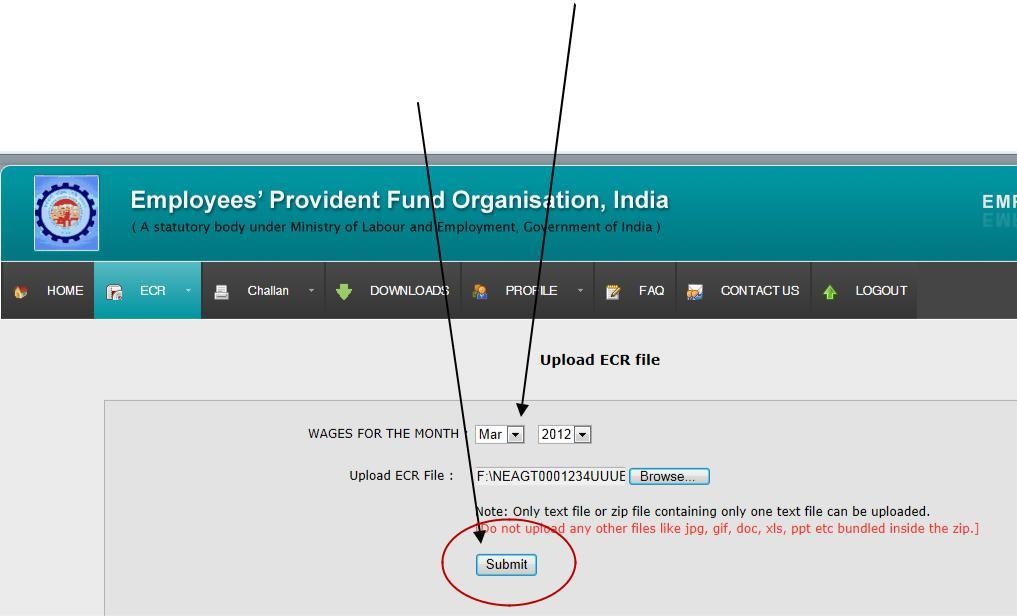

- Once, you click on that ECR Upload button, then it will open a new web page as shown as below.

- Now, upload your ECR file that you have been saved on your harddrive.

- Make sure it was completely in the best format that we had explained above and choose the wage month and year where you are going to upload your ECR ( Electronic Cum Challan ) as shown in the following image.

- If the uploaded ECR file doesn’t contain any mistakes, then the next webpage will look alike this, once you click on submit button.

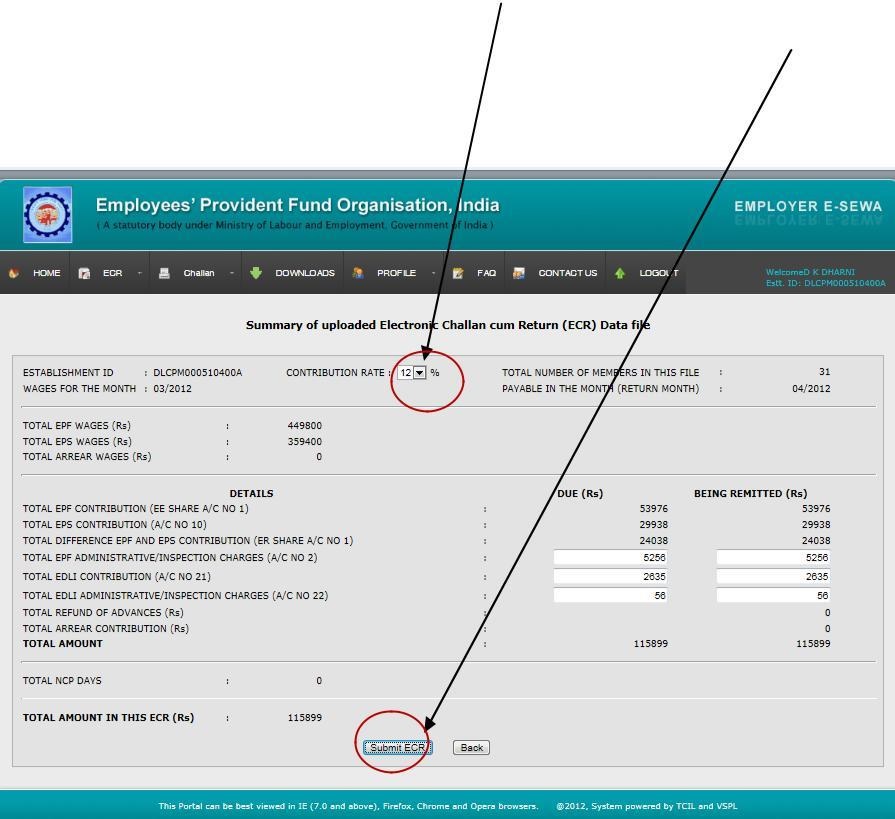

- Now, enter additional information as like ” EDLI and EPF/EDLI administrative and inspection charges.

- It’s all up to you choose the contribution percentage, as per EPF online payment portal the contribution rate is 12% by default.

- You can even decrease or increase it. As shown in the following image.

- Now, click on submit ECR button. Make sure to check out the complete information over and over again. Once you have done a conformation alert popup will display on the screen click on OK and proceed the next steps.

- Once you were done. A digitally signed PDF file will appear on screen with both time and date. Now, just click on ” Approve .”

Note: Some times, the digitally signed ECR may not appear due to the more number of employees ( 200+ ) in that case wait for some time,

until you receive an SMS to view or download the ECR file online in order to proceed the epf online payment.

Download The ECR Challan:

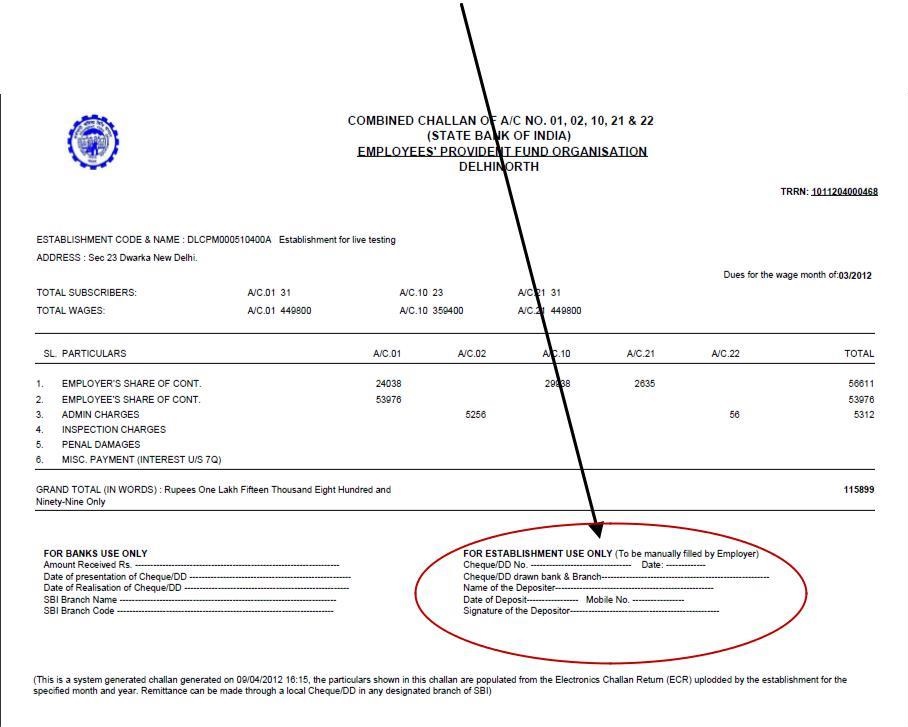

Once, you click on approve button, then the next page is to ” downloaded the challan form.” On Approval of challan, a temporary reference number ( TRRN ) will generate for the uploaded file.

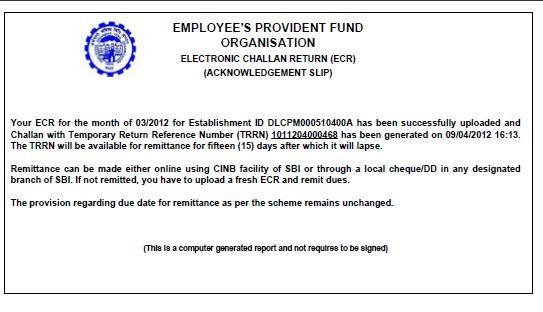

- Here you can access both ” Challan and ” Acknowledgment Receipt ” for your uploaded file for online epf payment online.

Below we share the following images how ” Challan ” and ” Acknowledgment receipt “

Challan Will look alike as follows:

And, Acknowledgment File will look alike as follows:

Note: The challan that has been generated will last 15 days if remittance not made.

- Until this time, the employer will have an option to reject the approval ECR. In case if remittance is done, there is no option to decline once remittance was done.

Make EPF online Payment : ( Offline has been shared below )

So, you successfully done both steps now next step is PF online payment.

Creating an account and generate ECR and uploaded it – At the right top bar menu, you will see an option to note down your TRRN ( Temporary Return reference number).

As we told earlier the temporary return reference number will only stay for 15 days.

If you failed to make remittance, then you need to upload it again to proceed the EPF payment online.

Make EPF Online Payment:

There is two processes to make pf online payment via online or offline.

Here we cover the online process followed by offline.

Make sure you have a TRRN number along with you while you can make the pf payment online.

- For Instance: We will choose the Two Banking sectors which were popular and most of the people will use in order to do the payments online via net banking under a corporate account.

SBI – Flow Of process ( To make EPF Online payment Via SBI followed By HDFC )

- Here is the official Link to log on to SBI corporate account: Link Here

- Now choose a corporate account and login with your credentials.

- There is an option at the top of the menu bar as ” Payments/Transfer “ And pick EPF there by.

- Proceed the payment from your account and authorize the details.

- Once, it was done now you can take printout of challan.

That’s the complete step by a process to proceed via SBI corporate account in order to make epf payment via online. Here we do cover the another bank ( HDFC ) in case if you follow this bank.

HDFC – Process Flow Of EPF Online payment

- Log on to HDFC Corporate Bank ( For Enet ) enter TRRN number.

- HDFC Bank for Net-banking enter TRRN number.

- Proceed the payment.

Procedure Of Payment Via Offline

If you have no corporate account, you can make remittance via offline to proceed the EPFO payment. Do check it out.

- The remittance cane be made through Demand draft/local cheque in any bank / branch.

- Once the cheque against realized ,you will get an sms alert of a specific month.

Below we do share the list of banks that accept epf payment online.

Almost on all banking sectors, the option is same as like above. Make sure to follow all the rules that were mentioned in above.

List Of Banks For EPF Online Payment Facility

The following are the list of banks that accept epf payment online. All of the banks will have both Retail And Corporate Internet Banking.

If you have any doubts regarding the list of banks that accept for the pf online payment.

Then do leave a comment here at the end of the post. Our team will help you out 🙂

| Bank Name | Bank Name | Bank Name | Bank Name |

|---|---|---|---|

| 1.Axis | 2.Bank Of Baroda | 3. Bank Of India | 4.Bank Of Maharashtra |

| 5.BNP Paribas | 6. Canara | 7. Catholic Syrian | 8. City Union |

| 9. Corpoation | 10. Cosmos | 11. Deutsche | 12. Development Credit |

| 13. Federal | 14. HDFC Limited | 15. ICICI Limited | 16. Indian Overseas |

| 17. Jammu and Kashmir | 18. Janta Sahkari | 19. Karur Vysya | 20. Kotak |

| 21. Lakshmi Vilas | 22. Oriental Bank of Commerce | 23. Punjab & Maharashtra Coop. | 24. Punjab and Sind |

| 25. Punjab National | 26. Ratnakar | 27. Shamrao Vithal Co-op. | 28. South Indian |

| 29. State Bank of Bikaner and Jaipur | 30. State Bank of Hyderabad | 31. State Bank of India | 32. State Bank of Mysore |

| 33. State Bank of Patiala | 34. State Bank of Travancore | 35. Syndicate | 36. UCO |

| 37. Union Bank of India | 38. United Bank of India | 39. Vijaya | 40. Allahabad |

| 41. Andhra | 42. Bank of Bahrain and Kuwait | 43. Central Bank of India | 44. Dena Bank |

| 45. Dhanlaxmi | 46. IDBI | 47. Indian | 48. IndusInd |

| 49. ING Vysya | 50. Karnataka | 51. RBS (The Royal Bank of Scotland) | 52. Saraswat |

| 53. Standard Chartered | 54. Tamilnad Mercantile | 55. TNSC | And, 56. Yes Bank |

Most Frequent Asked Questions About The EPF payment :

Here we cover the most frequent asked questions, hope this will help you in case if you need to know any more information check out here: List of 50+ Most Frequent Asked Questions

1) Why it is mandatory for employers to register on a portal website?

A: With effect from 01/04/2012 any remittance would be done after generating challan from a portal website.

It is mandatory to view your data online. In case if any mistake will happen during the ECR.

2) What If I don’t register on the portal ?

A: Simple! You won’t have any access to generate the online challan.

3) What if my establishment I’d won’t retrieve our details?

A: Please do check it out once.

In case if this still happening then contact the concerned EPFO office to solve your problems asap.

4) Whenever I entered my establishment info and click on ” Get details ” The message showing as ” Your establishment is already registered ” What should I do now?

A: Please check whether you have entered the correct code number and extension number, if any and have selected the right EPFO Office.

- If correct, click the link for generation of request letter.

Print the letter and submit it under the signature and seal of the Employer/Authorized Signatory to the EPFO Office where the establishment is covered.

- Please mention your mobile number in the letter.

Once the EPFO Office clears the registration, you will get an SMS on that mobile, and then you can register.

Here is the list of 50+ questions covered under each category taken from the EPFO office.

which will help you a lot in case if you were done any mistake while filling out the registration process or generating ECR or making epfo online payment.

Benefits Of EPF Payment Via ECR:

The EPFO government had done this change back in 2012 for employers.

As per survey under an act of EPFO, it is very hard to complete the flow of process payment via online. So, to done this process hassle free the central government has made this decision.

Here are some of the benefits:

- The employer, No need to submit other returns from 5/10/12A, 3A, and 6A.

- Say good bye to a paper return.

- Once an employer is doing the payment, within a fraction of second, they will receive the message of success payment via EPFO.

- Now, employers will have access to view the annual account slips during a year.

- The contribution will automatically credit to the member’s account on a monthly basis.

- You can access annual slips for earlier years through this portal website.

That’s the comprehensive benefits.

The central EPFO government is also planning to launch the new portal where they provide 24×7 support to the employees if they made any mistake and can resolve instantly.

Then do leave a comment here our dedicated team will help you out related to this query.

Leave a Reply